Have you heard? Los Angeles has a housing problem! We’re over 450,000 housing units short based on the latest RHNA (Regional Housing Needs Allocation) assessment. Need a recap on why? Check out our short history lesson on housing and how we got here: Part 1 and Part 2, and then read up on the latest Housing Bills California has implemented to help: Housing Bills 101 and Housing Bills 102.

Fast forward to now: what do these bills ACTUALLY mean? Often, we, as voters, don’t get to see the nitty gritty, behind-the-scenes details of building approval and whether or not the intended outcomes are actually achieved. Have no fear — Tracy A. Stone Architect is here! We’ll give you a quick rundown of a couple specific projects and how they have been affected. Some have proceeded as intended; others not so much.

Case Study 1: Westwood Apartments

Zone: [Q] RD1.5-1

Specific Plan: Westwood Community DRB/Multi Family Standards

Existing Use: Vacant Triplex

Background:

Back in 2019, this project was designed using the Transit Oriented Communities (TOC) Affordable Housing Incentive Program. This program was created by the city as a response to voter-approved Measure JJJ and provides incentives (such as reduced parking, increased height, decreased setbacks, etc.) for projects near major transit in lieu of dedicating units as affordable housing.

The site is currently developed with a triplex that has been vacant for at least five years.

The project went through years of planning review with the challenging Westwood DRB and was approved by Los Angeles City Planning in 2020 utilizing the TOC incentives, which would have created a net increase of seven units (of which two are dedicated as affordable).

Existing Allowed per RD1.5 TOC Incentives

3 vacant units 6 units total 10 units total/2 affordable

In 2022, a lawsuit was filed against the City of Los Angeles, stating (among other things) that TOC incentives conflict with regulations of the Westwood Specific Plan, and ultimately, the Los Angeles Superior Court agreed. The “Cliffsnotes” explanation is that a Specific Plan was created by an ordinance and the TOC guidelines do not hold any legislative authority to override.

Moving Forward:

The owner has switched gears and plans to construct three new accessory dwelling units (two detached, one attached) which will add to the existing three market rate apartments for a total of six market rate units. None are required to be affordable.

Conclusion:

Not only did the lawsuit keep the property vacant as the owner fought for resolution, but instead of adding 10 apartments to the neighborhood (two affordable and eight market rate), the project has now been downsized to provide a total of six market rate units. The city is losing out on four apartments, two of which were to be affordable, but the community is getting the type of low-scale, low-density they prefer.

Our client spent many years and significant money trying to provide affordable housing units for the area, only to have it backfire. It’s logical to assume this will end up costing the housing market in another way long-term (future development costs, sales of property, etc) as they scramble to reacquire some the lost funds. According to a recent AIA Article on affordable housing, “Currently, affordable housing tends to be a more difficult undertaking than market rate for developers. Affordable Housing Developers take on more financial risks, difficult funding requirements, and extended schedules. This leads to increased workload and operating costs. This should not be the case for developers who are trying to meet Los Angeles’ desperate demands for affordable housing.”

We have since heard some buzz suggesting the perks of the state-initiated bills (i.e., State Density Bonus program) as being more effective in promoting affordable housing development than city-wide programs, such as TOC.

Case Study 2 – Cochran Small Lot Subdivision

Zone: R3-1-O-HPOZ

HPOZ: Miracle Mile HPOZ

Existing Use: Vacant Triplex and Vacant Single Unit

Background:

The site is currently developed with four rental units that were vacated before 2019 (approximately four years ago) via the Ellis Act.

Back in 2021, just as the city was starting to issue implementation guidance for SB330 Housing Crisis Act, this project was submitted to planning as a five-unit small lot subdivision (aka five market rate for-sale single family homes). The owner had settled on this number of units (severely under-developing the site) because the location is in a historic district. The project then went through multiple review meetings with the local HPOZ board, and maintained a lower profile and more open space on the lot in order to fit into the existing historic context.

As the case file was being reviewed by the city, the owner was required to provide proof of income as a part of the RUD (Replacement Unit Determination) process to determine how many replacement units must be affordable. Since the property was vacated prior to ownership, this has proven quite difficult. If no income information is available for previous tenants within the five-year lookback window, the Housing Department has determined these cases should proceed with a “default determination” of 70%. For this particular project, that means three of the existing four units would need to be considered “affordable”.

Existing Allowed per R3 Proposed Development

4 vacant units 10 units total 5 units total/0 affordable

Moving Forward:

In response, the owner is doing just what SB330/SB8 intended: researching the past tenant information to figure out how many units are required to be replaced/affordable. If the income information is not found, three of the five units proposed must be affordable.

Conclusion:

This is exactly what’s intended by the state bills: (1) no net loss of units and (2) replacing any existing affordable units. Unfortunately, dedicating 60% of the development as affordable makes the project economically infeasible. While we fully support the concept of ensuring affordable units are available to local residents, if the owners can’t make it work financially, we are left with zero development — no new units and most importantly, no dedicated affordable units.

What other options are available?

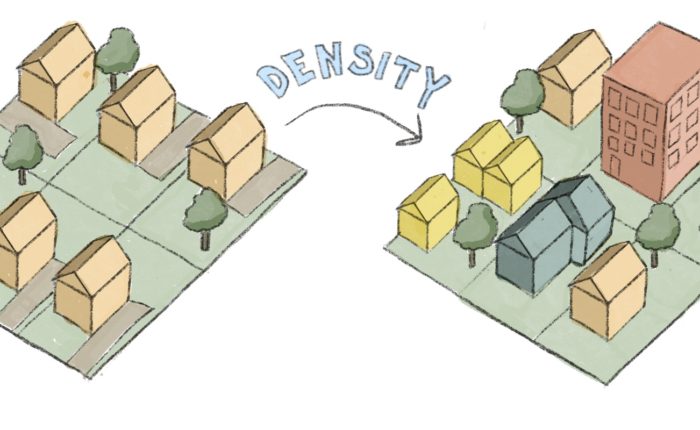

Option 1: By-Right Development of 10 apartment units, dedicating three, or 30%, as replacement affordable units. No incentives available. Note, this building would have a bigger footprint and larger massing than the five houses proposed by the developer. This would be a “win” for the city in general, increasing housing stock, but a loss for the historic neighborhood which is limited by State law in their ability to review height, density and massing.

Option 2: TOC Development of up to 19 units, dedicating between 10-30% as affordable depending on the number of incentives needed. Note, this building would be much taller, larger, and bulkier than the five houses proposed by the developer. Again, this would be a “win” for the city in general, increasing housing stock, but a loss for the historic neighborhood which is limited by State law in their ability to review height, density and massing.

We also note that, while this sounds like a great idea to squeeze 19 units on the site (an almost 100% increase on the by-right option!), it can be difficult to fit this high number of units on the lot and still maintain good quality units. We did a feasibility study to mock up a few options and couldn’t comfortably fit more than 16 units on the site, of which four were dedicated as affordable (25%). Incentives to do this include reduced parking (0.5/unit), extra height (+22’), reduced yards (-30% of two yards), and reduced open space (-25%).

This is a great option for a developer who has the financial ability to take on such a large project, as the construction cost is nearly four times the original development proposal of five units. It would certainly price out many smaller-scale owners/teams.

In closing….

These are two very different outcomes of the impact of local and state programs pushing for the creation of affordable housing. We wholeheartedly support the State’s efforts to streamline housing projects while protecting the existing affordable housing stock. However, outcomes can be hard to predict, and there are significant “growing pains” as cities and communities adapt to the new reality. Many of the new bills have caused permitting and review headaches (witness the need for buyers to have historic tenant data on rental units for vacant buildings) that are adding time and money to development. We look forward to a future where these processes become established and really result in a streamlined entitlement/permit experience.

We welcome your feedback and thoughts on the impacts you are experiencing with all the new bills. If you have questions on how these bills apply to your property, reach out to us at Tracy A. Stone Architect!